If you’ve been browsing housing listings or talking to friends about refinancing, you’ve probably felt the sting of it: mortgage rates are climbing once again in 2025. Headlines shout about it, economists debate how high they’ll go, and frustrated buyers watch their monthly payment estimates creep up week after week.

But why exactly do rising mortgage rates matter so much to everyday people—whether you’re buying your first home, thinking about selling, or just trying to keep your household budget afloat?

This isn’t just some abstract financial story that only bankers care about. Today’s higher interest rates on mortgages ripple through everything from your monthly payment to the health of the broader economy. They influence how much home you can afford, whether you can refinance to save money, and even the prices of homes themselves.

In this in-depth guide, we’ll break down:

✅ What’s driving mortgage rates higher in 2025

✅ How rising rates impact first-time homebuyers

✅ What it means for current homeowners

✅ The surprising ways it affects rent, inflation, and the entire economy

✅ Smart strategies you can use right now to protect your finances

By the end, you’ll see why today’s rising mortgage rates matter to you—and what you can do to navigate this tricky housing landscape.

📈 Why Are Mortgage Rates Rising in 2025?

Let’s start with the basics: Why are mortgage rates climbing in the first place? Understanding this helps you see why it’s unlikely to stop anytime soon.

🔥 1. The Federal Reserve’s anti-inflation battle

Throughout 2022-2024, inflation soared well above the Fed’s 2% target. Even by mid-2025, core inflation remains sticky, hovering around 3.5%. In response, the Federal Reserve has kept the federal funds rate higher for longer. As of June 2025, it’s still sitting at 5.5%, one of the highest levels since before the 2008 crisis.

Mortgage rates track closely to the yield on 10-year Treasury bonds, which are heavily influenced by the Fed’s moves. Higher Fed rates → higher Treasury yields → higher mortgage rates.

🌍 2. Global uncertainty & investor caution

Geopolitical tensions, energy supply disruptions, and uneven growth in Europe and Asia have all pushed investors into safer long-term bonds. Ironically, this has sometimes kept Treasury yields from soaring even more. But risk premiums on mortgages are still elevated because lenders worry about potential defaults if the economy slows.

🏦 3. Banks pricing in risk

After several high-profile regional bank scares in 2024, lenders are more cautious. They’re building extra buffers into mortgage pricing to protect against borrower defaults. That pushes the mortgage rates you see advertised even higher.

🏘️ What Does This Mean for Homebuyers in 2025?

If you’re looking to buy a house this year, the impact of rising mortgage rates hits immediately and painfully.

💰 1. Your monthly payment jumps

Here’s a quick illustration. Let’s compare monthly payments on a typical $400,000 home with 20% down (so a $320,000 mortgage):

| Rate | Monthly Payment (30-year fixed) |

|---|---|

| 3% | $1,350 |

| 5% | $1,720 |

| 7% | $2,130 |

At today’s average 30-year fixed mortgage rate of ~7% in mid-2025, you’re paying $780 more each month than if you bought back in 2021 when rates were around 3%. Over 30 years, that’s nearly $280,000 extra in interest.

That’s why every news story on the housing market keeps hammering on mortgage rates—they have a direct, massive impact on what you can afford.

🚪 2. Many buyers get priced out entirely

Because monthly payments drive lender approval (your debt-to-income ratio), many people who could qualify for a $400,000 mortgage at 3% now only qualify for $300,000. That means smaller homes or different neighborhoods, or waiting it out altogether.

🏠 How Rising Mortgage Rates Hit Current Homeowners

Even if you already own a house, today’s rising mortgage rates affect you in surprising ways.

🔄 1. Goodbye, cheap refinancing

Remember 2020-2021, when people were refinancing in droves, locking in sub-3% rates? That party’s over. If you locked in back then, you’re golden. But if you missed it, or if you took an adjustable-rate mortgage that’s resetting now, your payment could jump dramatically.

🛠️ 2. Home equity loans cost more

Homeowners often tap equity for renovations, college tuition, or paying down credit cards. With rates on HELOCs and home equity loans now in the 9-10% range, borrowing against your home is much pricier.

🏡 3. Selling & “rate lock-in” problems

A huge number of owners are “rate locked”—sitting on their old 3% mortgage and unwilling to sell, since buying a new home means a loan at 7%. This is one reason housing inventory remains so low in 2025, ironically pushing prices up even as demand slows.

💸 The Broader Economic Impact: Why You Should Care Even if You’re Not Buying or Selling

Maybe you’re thinking: “I’m renting, or happy in my home with no plans to move. Why should I care about rising mortgage rates?”

Turns out, mortgage rates have big ripple effects:

🏠 1. Rents often go up

When people can’t afford to buy, they keep renting. Landlords see high demand and low vacancy rates—so rents climb. In many U.S. cities, average rents are still rising 5-6% annually in 2025, partially because of these locked-up homebuyers.

💼 2. Construction jobs & local economies slow

Fewer buyers mean fewer new homes get built. That hurts construction employment and local businesses tied to homebuilding—from electricians to appliance stores.

💳 3. Household spending gets squeezed

If homeowners are paying hundreds more each month on mortgages (or potential buyers are saving frantically for bigger down payments), that’s money not going to restaurants, vacations, or retail. Rising mortgage rates cool consumer spending, which is a huge part of the U.S. economy.

🧐 The Psychological Impact: Consumer Confidence & Housing Dreams

There’s also a big emotional side to rising mortgage rates.

🌅 The American dream gets more elusive

Homeownership has long been the cornerstone of wealth building. As rates rise, many young families feel locked out. This can have long-term consequences on household net worth and even birth rates, since people often delay starting families until they can afford stable housing.

😰 Worries about future values

Some prospective buyers fear buying at the top, only to see home prices stagnate or dip. Others worry that taking on a big mortgage at today’s rates could strain their budget if layoffs hit.

🔍 Is There Any Good News for Homebuyers in 2025?

It’s not all doom and gloom. Rising mortgage rates have at least brought some balance back to the housing market after the frenetic bidding wars of 2020-2022.

- There are fewer all-cash investors, so first-time buyers sometimes face less competition.

- Sellers are more willing to negotiate on repairs or price.

- Many markets that overheated are seeing price moderation. Home values aren’t plunging broadly, but they’re rising much more slowly.

Plus, financial advisors often say: “Marry the house, date the rate.” If rates fall in a few years, you can refinance.

📝 Smart Strategies to Handle Rising Mortgage Rates

So how do you navigate today’s higher mortgage rates in 2025?

🔍 1. Shop aggressively

Lenders’ rates vary more than you might expect. In this market, getting multiple quotes can save you half a percent or more, which is huge over 30 years.

💰 2. Consider points or buydowns

Paying a little more upfront (discount points) can lower your rate for the life of the loan. Some sellers are even offering to cover these costs.

🏦 3. Explore shorter-term loans

If you can afford higher monthly payments, 15-year or 20-year mortgages come with lower interest rates and dramatically less total interest.

🚀 4. Build your credit score

A 720+ FICO score can still unlock noticeably better rates than a 650. Even 20 points higher might mean thousands saved.

🛠️ 5. Watch for ARMs—but carefully

Adjustable-rate mortgages are making a comeback, starting lower than 30-year fixed. Just be sure you can handle future resets.

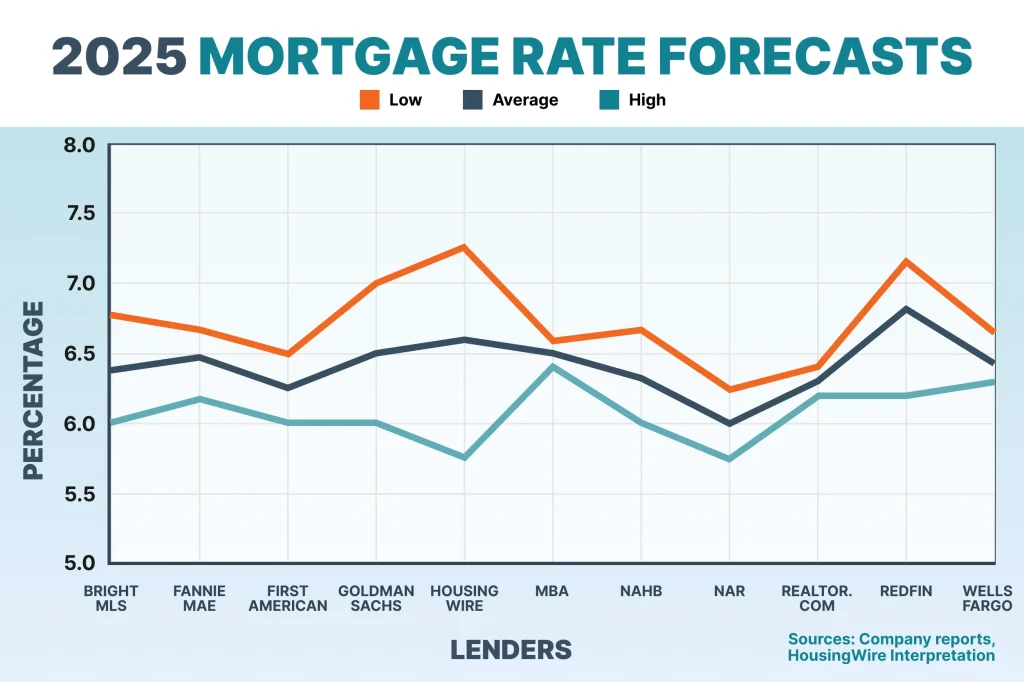

📊 What the Experts Predict for Mortgage Rates Through 2025

So will rates keep rising forever?

Most economists think 2025 is the peak, or close to it. Inflation is finally trending down, and the Fed is expected to begin modest rate cuts by mid-to-late 2026. That means mortgage rates might drift down—but not to the sub-3% levels of the pandemic. Many predict 5-6% could become the new normal.

So the advice many planners give is:

✅ If you find a home you love and can afford the payment, buy.

✅ If rates drop later, refinance.

✅ If they don’t, at least you’re building equity.

💬 Real People, Real Impact: Stories from 2025

To show how rising mortgage rates matter on a human level, here are a few snapshots:

🏠 First-time buyers delaying dreams

A couple in Chicago saved for years to buy their first home. When they started shopping in 2023, a $400,000 home seemed within reach. Now with higher rates, they’ve put their plans on hold—renting another year to save more.

🔄 Owners stuck by low rates

A family in Phoenix would love to upsize, but they’re locked into a 2.9% mortgage. Buying bigger now means nearly doubling their payment, so they’re remodeling instead.

👷 Builders slowing projects

A mid-sized builder in North Carolina reported pulling back on new developments, worried fewer buyers can afford $500,000 homes with today’s rates. That means fewer local construction jobs.

🧭 Key Takeaways: Why Rising Mortgage Rates Matter To You

✅ They dramatically change monthly costs. The same house costs hundreds more each month at 7% vs. 3%.

✅ They ripple through the whole economy. Higher mortgage rates slow consumer spending, impact jobs, and even push rents up.

✅ They affect your wealth-building timeline. Owning later means building equity and home appreciation later.

✅ But they also create opportunities. Less competition, slower price growth, and potential future refi savings.

🎯 Final Thoughts: Navigating the 2025 Housing Market with Confidence

In 2025, rising mortgage rates might feel like just another piece of bad financial news. But understanding why they matter—both to your personal budget and to the bigger economic picture—gives you power.

If you’re a buyer, focus on what you can control: improving your credit, shopping for the best rate, and buying within your means. If you’re an owner, keep an eye on future refinancing opportunities. And if you’re renting, remember that these high rates are one reason rents stay elevated—so smart budgeting matters now more than ever.

Because whether we like it or not, mortgage rates shape nearly everything in the housing market. And that means they shape everything from your living situation to your long-term wealth. Knowing how to navigate them is one of the smartest financial moves you can make in 2025.

author ; trendystag