Big Finance, The world of SPACs (Special Purpose Acquisition Companies) is always buzzing with activity, but some moves grab more attention than others. This week, Thayer Ventures Acquisition Corporation II (NASDAQ: TVAIU) shook things up by announcing it will split its shares and rights, creating new standalone tradable securities under separate tickers.

This isn’t just another minor stock adjustment. For both institutional players and retail investors dabbling in SPACs, this split is a notable shift with important implications. In this deep dive, we’ll break down:

✅ What exactly Thayer Ventures is doing

✅ Why SPACs split units into shares & rights

✅ How it changes the game for investors

✅ Risks & opportunities in these newly separated securities

✅ What the move says about the broader SPAC market in 2025

By the end, you’ll be fully equipped to decide whether this is an opportunity to watch closely—or a risk to approach with caution.

📊 What Did Thayer Ventures Just Announce in Big Finance?

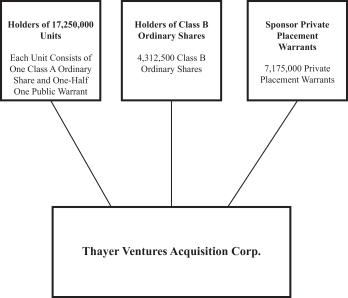

Let’s start with the core news. On July 2, 2025, Thayer Ventures Acquisition Corporation II announced that its units (previously trading under ticker TVAIU) will be **split into:

- Common shares: Trading under TVAI

- Rights: Trading under TVAIR

Prior to this split, buying TVAIU units meant you automatically held a bundled package—typically one common share plus a fraction of a right or warrant. Now, these components are decoupled and will trade independently on the NASDAQ.

In practice, this means:

| Before | After |

|---|---|

| Holding TVAIU = 1 share + fractional right (bundled) | You now own separate TVAI shares + TVAIR rights, each with its own price and trading volume |

🚀 Why Do SPACs Split Units into Shares & Rights?

If you’re newer to SPACs, it may seem odd to buy a package that splits up later. But this is standard practice.

🏗️ The typical SPAC unit

When a SPAC IPOs, it sells units (like TVAIU), usually containing:

- 1 common share (the future stake in the merged company)

- A fraction of a warrant or right (bonus securities that might convert into shares or cash later)

It’s a way to sweeten the deal for early investors who are taking on risk before the SPAC finds a merger target.

🔄 The split process

After a certain period—often 52 days post-IPO, or whenever SEC filings allow—the SPAC will split its units into the individual securities, letting investors:

- Keep or sell the common shares

- Trade the rights/warrants separately (they often have higher risk/reward profiles)

This unlocks more flexibility and lets different investors pursue different strategies.

💡 What Are “Rights,” Anyway?

Here’s where many casual investors get fuzzy. Unlike standard shares, rights don’t immediately represent ownership. They’re agreements that typically convert into shares if the SPAC completes a successful merger.

For example:

- Each TVAIR right might convert into 1/10th or 1/20th of a common share upon business combination.

This means if Thayer Ventures finds a great travel or hospitality tech target (their focus area), these rights could become valuable equity—Big Finance without paying extra later.

But if no merger happens or the deal is bad? Those rights can become worthless. That’s why they trade much cheaper than shares.

⚖️ Why Investors Pay Attention When SPACs Like Thayer Ventures Split Shares & Rights

Splits like this create new trading dynamics and open up different plays.

🎯 For speculators:

Rights Big Finance and warrants often see volatile price swings, especially with rumors of target companies. Traders might load up on rights hoping for a big post-merger jump.

💵 For conservative investors:

You might prefer to hold just the common shares, which generally Big Finance have a clearer value floor (redeemable for cash if no merger happens).

🔍 For arbitrage players:

Some sophisticated investors try to exploit pricing inefficiencies right after the split—buying whichever security looks temporarily undervalued compared to its theoretical value.

📈 What Could This Mean for Thayer Ventures’ Future Price?

Right now, the market is watching TVAI and TVAIR closely. Big Finance History suggests:

- Rights often start cheap—a fraction of the share price, reflecting their uncertain future.

- If Thayer Ventures announces a promising acquisition in travel tech (their target sector), TVAIR rights could surge on speculation they’ll become valuable new shares.

- If there’s no deal (or a bad one), they could fade to near-zero.

Meanwhile, TVAI shares might fluctuate less dramatically, anchored by the redemption rights investors have if they don’t like the merger.

🔥 Risks of Trading Newly Split Rights

Investing in SPAC rights is definitely not for the faint of heart. Here’s why:

🚩 No guaranteed value: If Thayer Ventures doesn’t close a deal, or the deal fails to clear shareholder votes, rights expire worthless.

🚩 Highly speculative moves: News, rumors, or even Twitter threads can send prices spiking or crashing in a single day.

🚩 Liquidity concerns: Rights often have lower trading volumes than common shares. You might struggle to exit a position quickly without moving the price.

🏦 Why Did Thayer Ventures Choose Now to Split?

Most SPACs split units like Big Finance this by design—usually after SEC lock-up periods. It’s a scheduled part of their lifecycle, not a special new strategy.

However, the timing does matter. As of mid-2025:

- The SPAC market has shrunk from its 2021 frenzy, but strong management teams and sector-focused plays (like Thayer Ventures’ emphasis on travel & hospitality tech) still attract capital.

- Investor appetite is more cautious now, so separating units lets different types of investors decide precisely which risk profiles they want.

🔍 Thayer Ventures: The Bigger Story

Thayer Ventures isn’t a random shell company. Big Finance They’re well-known in hospitality and travel circles, with previous funds investing in:

- Duetto: hotel revenue management software

- RootRez: online booking tools

- Life House: boutique hotel management tech

Their stated mission is to merge with a high-growth travel tech firm, ideally capitalizing on post-pandemic travel booms.

For investors, the separated shares & rights give two ways to bet:

- TVAI (common shares): More stable, Big Finance redeemable if you don’t like the merger.

- TVAIR (rights): Cheap lottery tickets that could become valuable stock in a hot travel tech player.

🚀 Could This Split Signal a New SPAC Cycle?

Many analysts believe 2025 is seeing a cautious SPAC comeback after 2021’s overheated market and 2022–23’s painful resets.

- SPACs with clear sector expertise (like Thayer Ventures) are better positioned to find attractive deals.

- Rights and warrants still appeal to risk-hungry investors hunting for asymmetric payoffs.

- However, regulators remain watchful, and many retail traders burned by failed SPACs are wary.

The bottom line: This is still a stock-picker’s market, Big Finance not a SPAC free-for-all. Strong sponsors with clear targets stand out.

📝 Should You Buy TVAI or TVAIR?

We can’t give financial advice, but here’s a simple investor mindset guide:

✅ If you’re cautious or income-focused, you might prefer the TVAI common shares, which come with redemption protections.

🔥 If you’re risk-tolerant and chasing upside, the TVAIR rights could be enticing—but understand they can go to zero.

Big Finance Or you might simply watch the story unfold. Often, the best opportunities emerge after a merger announcement, when you can evaluate the target business directly.

📚 Key Takeaways on Thayer Ventures Splitting Shares & Rights

✅ The move is standard for SPACs, not a sign of distress. It simply unlocks investor flexibility.

✅ Rights trade cheap because they’re speculative—valuable only if a good deal happens.

✅ Thayer Ventures has a credible travel tech track record, so the market is watching closely for merger news.

✅ Know your risk tolerance. Rights can deliver huge returns—or become worthless. Shares have more stability.

🏁 Final Thoughts

Thayer Ventures splitting shares and rights isn’t just an isolated finance footnote. It’s a vivid look at how modern SPAC investing works—and why it still captures the market’s imagination.

If you’re an investor, keep this story on your radar. Watch for:

- Press releases about potential travel or hospitality tech acquisitions.

- Early price signals in TVAIR rights—they often move first.

- Institutional 13G filings (large ownership disclosures) that hint at big players moving in.

SPACs remain one of Wall Street’s most fascinating experiments. Whether this one becomes a runaway success or another cautionary tale will unfold in the months ahead. Either way, it’s bound to be a revealing ride.

✅ Want more finance breakdowns?

Tell me what stocks or sectors you’re tracking, and I’ll craft deep-dive 1500+ word blogs—plus keyword research and meta descriptions—so your website stays ahead of the curve.

If you’d like, I can also turn this into 3 shorter SEO-optimized posts (like “How SPAC Rights Work,” “Why Thayer Split Now,” and “Top Risks of TVAIR”) to spread across your site.

Just say the word!

Stay stylish, stay effortless. ✌️ with trendystag

author : trendystag.com